Estate Planning

Estate Planning is an important part of financial planning. It is necessary to have an estate plan in place so that your wealth is transferred to intended beneficiaries without hassles. It is not a simple process and therefore enlisting the help of a financial planner or a professional will help you in getting it right.

Estate means the net worth of a person. Estate planning refers to making arrangements such that your wealth is taken care of and distributed to beneficiaries, as you desire after your death without too many legal hassles. It is an important aspect of personal finance and financial planning, irrespective of how big or small your net worth is in your opinion. It is better to take professional assistance for estate planning, as it is a tough task. Here are some guidelines.

Creating a will: It is important to draft a will. The will should state the wealth that you have and how it should be divided between your beneficiaries. It should also contain information about how donations should be taken care of. It can be either handwritten, in a computer file or there are even online services that can draft your will. It is important to name a person who will execute the will when you are not there. You should sign the will in the presence of witnesses. For more information on creating a will, you can read our article by clicking here.

Setting up a Trust: The other way to secure the transfer of one’s net worth as desired is to set up a trust. This is normally done when the intended beneficiaries of the estate are not ready to take up the responsibility. The trust will take care of the estate and when the beneficiaries are ready to take up the estate, it will be handed over to them.

Division of assets and liabilities among heirs: Estate Planning involves listing down legal heirs who may not necessarily be relatives and detailing out who gets which part of the estate. Documentation of this aspect is important so that there is no confusion on who gets what.

Nominating a guardian for dependents: If you have any dependents, the estate plan should state how they should be taken care of in your absence. The plan should highlight who should be responsible for the dependents. For example, if you are taking care of disabled relatives, you should detail out how they should be taken care of when you are not there.

Financial Planning: As you know, financial planning is an ongoing exercise, it is important to have a broad outline of steps in place so that the ones taking care of your finances and do what is required to reach the financial goals set.

Review your estate plan: It is important to review/update the plan once in a while. Some reasons which could mean an update to the estate plan –

Value of net worth changes.

our relationships changes like you have a child or you remarry.

Laws related to estate planning change.

It is important to have an estate plan in place. Otherwise the estate would be given to legal heirs, as per the existing laws of the state, and not in the manner you had in mind. It has to be in place so that there are no complications on how your wealth should be distributed after your death.

Tax Planning

What Is Tax Planning?

Tax planning is a method by which one studies and avails of the deductions, exclusions, allowances and exemptions provided to him by the Government of India to save on his income tax. One needs to know which income tax slab he falls under. A careful study of the deductions available needs to be made and only those availed which makes one comfortable.

One needs to make time an ally and start planning for his taxes as early as possible and not wait until it is too late.

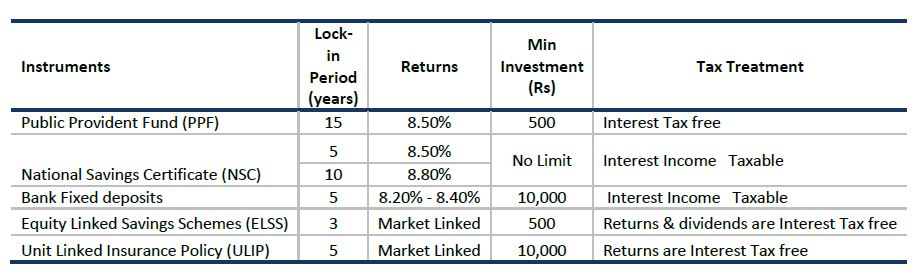

Comfort in tax planning basically depends on ones capacity to bear or tolerate risk. If one has a conservative bent of mind and is averse to taking risks he must make use of fixed income securities where the principle is not at risk. If one has a higher tolerance towards risk then equity linked savings schemes are the way to go.

The time horizon also plays a very important role in determining one's ability to bear risk. If one is older and around 50 years of age a public provident fund which has 15 years as a minimum lock in period for the amount invested might not be suitable. If one is young and has a lot of time on his side to invest known as a long term horizon then an aggressive instrument such as equity linked savings scheme is an apt choice.

Tax planning needs to be flexible and not set in stone. It is an ongoing or a dynamic pro cess which has to be tweaked according to ones need. It is a sound test of one's decision making ability.

It involves research and a study of a change in the income tax laws and their impact on ones tax liability.

The final decision in tax planning is the calculation of one's income tax liability based on the income tax slab he falls under and a judicious selection of the right avenue to save income taxes based on the risk tolerance.

In order to encourage savings, the government gives tax breaks on certain

financial products under Section 80C of the Income Tax Act. Investments made under

such schemes are referred to as 80C investments.

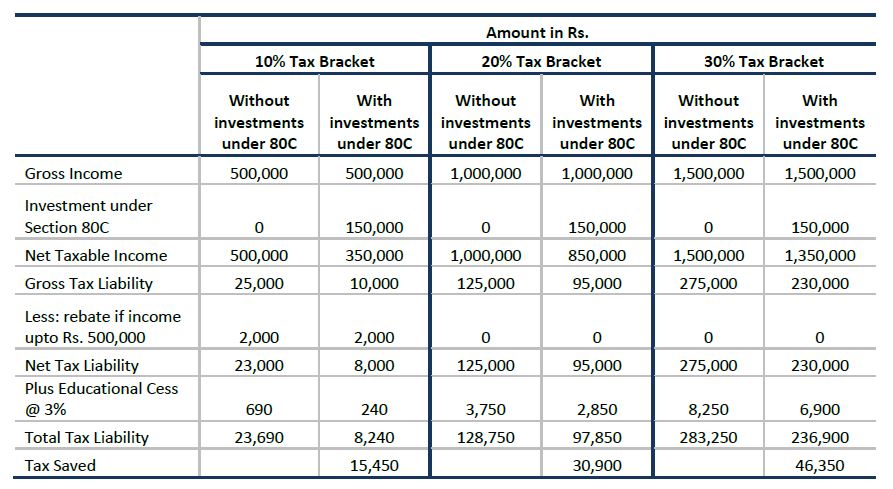

Section 80C of the Income Tax Act, 1961 allows certain investments and expenditure up to the maximum of Rs. 150,000/- to be deducted from total income for tax computation of the current Financial Year and if you are in the highest tax bracket of 30%, you save a tax of Rs 46,350/- as illustrated in the table below:

Features of SECTION 80C:

The deduction under section 80C is from your Gross Total Income

Available to an Individual or a HUF

The limit of deduction for current financial year is Rs 150,000

It is available to everyone, irrespective of his or her income levels

The various investment options under this section include:

Provident Fund (PF) & Voluntary Provident Fund (VPF):

PF and VPF is deducted directly from your salary by your employer.

Public Provident Fund:

An account can be opened with a nationalized bank or Post Office.

National Savings Certificate:

These are 6-years small-savings instrument, where the rate of interest

is 8% and is compounded half-yearly.

Equity-Linked Savings Scheme (ELSS):

Mutual funds offer you specially-created tax saving schemes

called ELSS.

Home Loan Principal Repayment:

The principal component of the EMI qualifies for deduction under

Section 80C.

Stamp Duty and Registration Charges for Home:

The amount you pay as stamp duty when you buy

a house and the amount you pay for the registration of the documents of the house can be claimed

as deduction under section 80C.

Five-Year Bank fixed deposits:

Tax-saving fixed deposits (FDs) of scheduled banks with a tenure of

five years are also entitled for section 80C deduction.

Others:

Apart from the above, things like children's education expenses that can be claimed as

deductions under Section 80C. However, you need receipts to claim the same.

Tax planning should not only be aimed at saving taxes but also to aid your investments to help you

achieve your financial goals. While there are many schemes that are offered to save taxes, ELSS can be

used to save taxes as well as for wealth generation as it invests heavily in Equities to ensure the desired

long term yields.

Disclaimer

@ Tax benefits are subject to the provisions of the Income Tax Act, 1961 and are subject to amendments, from time to time.

@ Tax benefits are subject to the provisions of the Income Tax Act, 1961 and are subject to amendments, from time to time.

Certain information contained in this document is compiled from third party sources. Whilst Mirae Asset

Global Investments (India) Private Limited has to the best of its endeavor ensured that such information

is accurate, complete and up-to-date, and has taken care in accurately reproducing the information, it

shall have no responsibility or liability whatsoever for the accuracy of such information or any use or

reliance thereof. This document shall not be deemed to constitute any offer to sell the schemes of Mirae

Asset Mutual Fund. Mirae Asset Global Investments (India) Pvt. Ltd/ Mirae Asset Trustee Co. Pvt. Ltd./

Mirae Asset Mutual Fund/ its Directors or employees accepts no liability for any loss or damage of any

kind resulting out of the unauthorized use of this document.

Mutual funds are subject to market risks, read all scheme related documents carefully.

Mutual funds are subject to market risks, read all scheme related documents carefully.

Why is tax planning necessary?

This is a question in the minds of all individuals of our nation and has a simple answer. If one is rich and very generous towards the Government then the answer is no. For those who are averse to doing so tax planning is a must.

The main aim of tax planning is to limit the income tax liabilities by making use of the tax deductions, exclusions and exemptions provided by the Government to reduce the net income taxes payable. Income tax is something none can escape. Without proper plan ning the full tax amounts needs to be paid based on the income tax slab one falls under. With proper tax planning one can save on the amounts which would otherwise result.